|

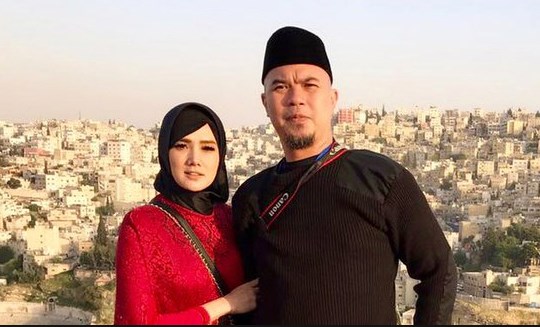

| Beginilah kepanikan Mulan Jameela menghadapi guncangan pesawat yang Luar biasa, saat Landing Pesawatnya di terpa angin Kencang. |

|

Sumber :http://makassar.tribunnews.com

Spotting False Term Life Insurance

False life insurance fraud is perhaps the most sensitive kind of insurance scam, since larger frauds are often discovered only after the death of the insured. Although buyer frauds are very common, and can even lead to the murder or suicide of the insured in order to cash in their insurance, this article focuses on seller fraud, where those selling or claiming to sell insurance are involved in the fraud.

Fake websites and agents

These exist for the sole intention of obtaining an unsuspecting person's money, usually through credit cards. Websites may be made to look like those of a genuine insurance company, or may represent a completely bogus organization. These can be recognized in a variety of ways, the easiest of which is to check whether the web address starts with https:// - this is a secure site and payment information can be entered here. Often, links to fake sites will be emailed to you, so check if the email is from a public account or your insurance company's account. Furthermore, hovering the mouse pointer over a link in the email will tell you if the email was sent from the same site, and not a fake one. It is important to remember that no bank or insurance company will tell you to "renew information" through an email. If you receive such an email from your bank, verify it by calling them, and not on the number given in the email!

Fake agents are a little trickier to detect, since both real and fake ones will approach you personally and advertise policies. Thieves collect premiums and do not pass them on to the insurance company. As a general rule, verify with your company beforehand if they have any policies and whether they have sanctioned agents to collect premiums.

Ghost companies

These "companies" are really just groups of con artists operating out of a single room, who dial their targets and sell them policies, claiming to be certified or licensed. The smartest thing to do is to check with your state or national insurance department whether these companies exist. As always, do not hand over credit card information over the phone, and ask around for any news on insurance scams.

Churning

This involves selling or advertising unwanted policies with an intent to generate commissions rather than yield any genuine benefits to the customer. For example, an annuity plan that generates cash but only after 15 years is unlikely to be popular among 60-year olds. Hiding the disadvantages of this plan, which often include paying large penalties or surrender fees in order to receive payment earlier, is often involved.

Similar to churning is selling plans that over or under-cover the client, only to generate commissions for the broker. The best way to avoid this kind of fraud is to run one's account independently, without letting brokers have discretionary authority over buying policies.

Article Source: http://EzineArticles.com